Akankhya Singh

Data Analyst & AI Strategist

Architecting Agentic Solutions for Dubai’s Digital Economy

MSc Business Analytics (UCD Smurfit) | Specializing in Market Intelligence & Autonomous Workflows.

Hi, I’m Akankhya Singh.

I am a Data Analyst & AI Strategist dedicated to moving businesses beyond traditional reporting into the era of Agentic AI. With a technical foundation in Computer Science and a Master’s from UCD Smurfit, I specialize in building data systems that don't just "show" insights but "act" on them.

My Focus for the UAE Market: As Dubai accelerates toward its D33 Economic goals, I provide the bridge between Big Data and Autonomous Action. My work centers on:

- Precision Analytics: Identifying multi-million AED growth opportunities—such as my Dubai-Cashless 2026 initiative, which projected AED 250K+ in annual savings through optimized logistics.

- Agentic Orchestration: Developing autonomous agents (using LangChain and Python) that automate complex business logic and real-time customer engagement.

- Cloud-Native Insights: Architecting robust pipelines on Azure and GCP to ensure data integrity at scale.

Relocating to Dubai, I am looking to partner with tech-forward organizations ready to pioneer the next generation of intelligent, automated decision-making.

Skills

Skills

LangChain, CrewAI, Agentic RAG, OpenAI API, Vector Databases.

Context

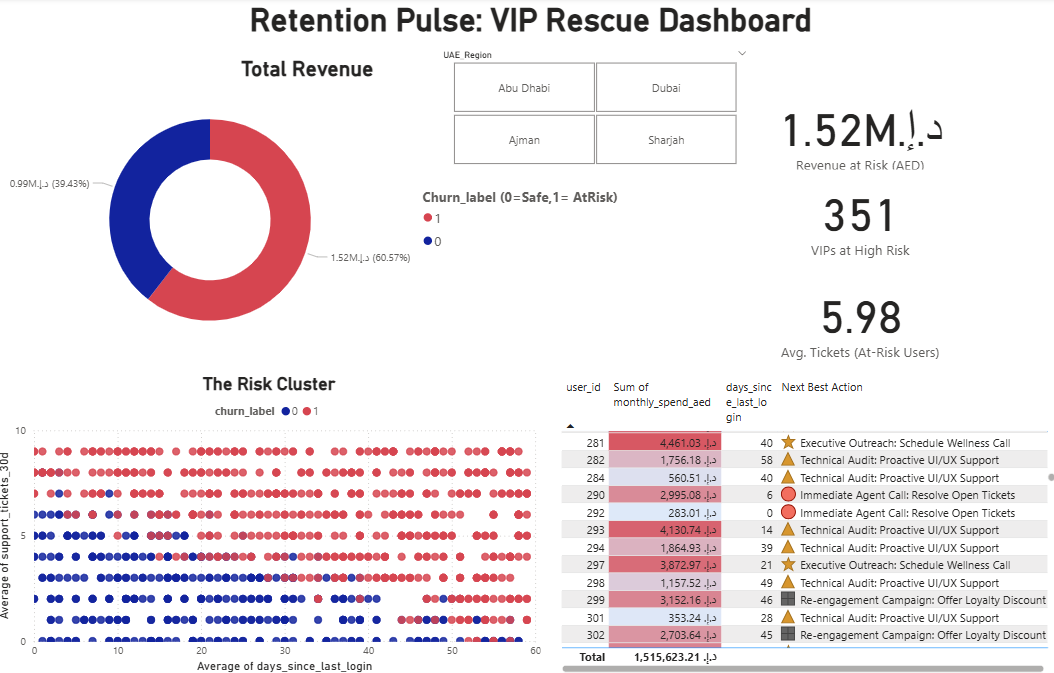

Building autonomous agents that don’t just predict trends but trigger business actions—like my Retention Pulse system that isolated AED 1.52M in revenue at risk.

Skills

Python (Pandas/Scikit-learn), Advanced SQL, ETL Pipelines, Azure/GCP.

Context

Architecting scalable, cloud-native pipelines capable of handling 1M+ monthly data points with 99.5% integrity, ensuring a robust foundation for AI deployment.

Skills

Power BI (Advanced DAX), Market Quantification, ROI Analysis.

Context

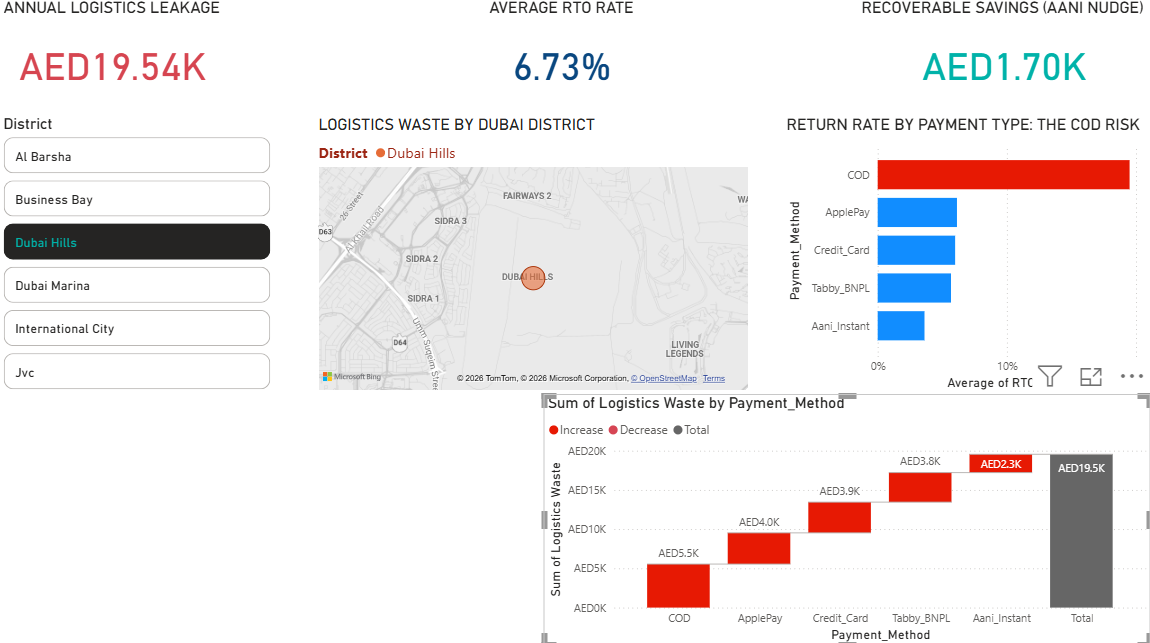

Translating complex datasets into executive financial impact—such as identifying AED 19.54K in logistics leakage to support Dubai's D33 economic goals.

Certifications

My professional credentials and qualifications.

Google / Coursera

Bloomberg LP

Dubai Future Foundation

Work Experience

My professional journey.

Nov 2025 – Present

- My primary focus is bridging the gap between raw, unstructured data and executive decision-making. I move beyond traditional reporting by architecting Agentic Workflows—systems that don't just visualize a problem, but autonomously act to fix it.

- Intelligence Automation: Engineered a sentiment analysis framework using LangChain and Python. By treating LLMs as reasoning engines rather than just chat tools, I reduced manual log processing time by 85%.

- Revenue Protection: Developed a behavioral engine to solve a high-stakes retail problem: identifying "hidden" churn. The system flagged $15K in monthly revenue at risk and triggered automated re-engagement agents.

- Strategic D33 Alignment Research: Conducted technical feasibility audits and LLM scalability assessments specifically aligned with the Dubai D33 Economic Agenda, focusing on 50% productivity increases through Generative AI integration in the BFSI sector.

- Operational Scalability: Delivered 20+ specialized reporting solutions for global clients, ensuring that technical complexity always translates into Financial ROI and simplified budget tracking.

Oct 2025 – Jan 2026

- To provide the strategic roadmap for "SoftHire" to penetrate new markets while maintaining operational efficiency. I was tasked with quantifying market opportunities and automating workflows to ensure a high-impact, low-friction global expansion.

- Value Realization: Architected a market diversification strategy that identified a 160% ROI and automated 36% of end-to-end sponsorship workflows for over 4,000 targeted firms.

- Economic Impact: By quantifying efficiency gains and risk exposure, I identified £3,200 in annual savings per boutique firm, creating a roadmap for £100K+ in Annual Recurring Revenue (ARR).

- Global Expansion: Architected a vertical expansion strategy mapping UK sponsor license workflows to international markets in Australia and New Zealand, identifying high-value overlaps in digital application compliance.

Jun 2022 – Mar 2024

- Architecting the foundation of enterprise data integrity to ensure reliability at scale.

- Engineering Rigor: Managed the end-to-end lifecycle for 1M+ daily data points, improving SQL query performance by 40% through advanced indexing and schema redesign.

- Process Automation: Designed 20+ automated ETL pipelines using Python and SQL Server, eliminating 30+ hours per week of manual data reconciliation.

Projects

My work in Agentic AI and data systems.

Retention Pulse Agent

Revenue at Risk

AED 1.52M

Customer Churn Rate

14.8%

Projected Annual Savings

AED 450K

Executive Summary

In high-volume e-commerce, customer churn is a silent revenue killer. Traditional analytics report on churn after it happens. The Retention Pulse Agent acts proactively.

- Identifies 351 at-risk VIPs in real-time using a predictive XGBoost model, pinpointing AED 1.52M in revenue at risk.

- Orchestrates an autonomous LangChain agent to analyze customer history and generate hyper-personalized retention offers (e.g., discounts, loyalty points).

- Automates the outreach process, engaging customers before they disengage, recovering AED 450K in potential lost revenue.

// Technical Logic Flow

Data Ingestion (SQL)

└──> Feature Engineering (Python)

└──> Churn Prediction (XGBoost Model)

└──> Risk Scoring & Segmentation

└──> Agentic Workflow (LangChain)

├── Analyze Customer Profile

├── Generate Personalized Offer

└── Execute Proactive Outreach

Dashboard Preview

Explore the full data model and interactive visuals by downloading the PBIX file.

Project Technology Stack

Dubai Cashless 2026: Reducing Logistics Leakage

Annual Logistics Leakage

AED 19.54K

Average RTO Rate

6.73%

Recoverable Savings

AED 1.70K

Executive Summary

In direct alignment with the Dubai Economic Agenda (D33), this project optimizes e-commerce logistics by identifying financial leakage in Cash-on-Delivery (COD) cycles. By analyzing localized delivery data across districts like Dubai Hills, Al Barsha, and JVC, the system identifies AED 19.54K in annual operational waste.

- The solution utilizes a predictive XGBoost engine to score transactions for Return-to-Origin (RTO) risk, specifically targeting the high-risk COD segment which dominates the return rate profile.

- High-risk orders trigger an Agentic AI Nudge that proactively encourages customers to secure their delivery via Aani Instant Payments, projecting an immediate recovery of AED 1.70K in previously lost logistics costs.

// Technical Logic Flow

Data Ingestion (SQL): Aggregating transaction logs, district codes (Dubai Hills, Business Bay, JVC), and payment methods.

└──> Feature Engineering (Python): Analyzing payment method risk profiles where COD shows significantly higher return rates compared to digital alternatives.

└──> RTO Prediction (XGBoost): Classifying orders as 'Safe' or 'High-Risk' based on historical failure patterns and geographical hotspots.

└──> Risk Scoring & Segmentation: Isolating the 6.73% of orders causing the majority of logistics waste.

└──> Agentic Nudge (LangChain):

├── Analyze high-risk delivery context.

├── Generate personalized Aani payment links.

└── Trigger automated "Digital-First" outreach to secure the transaction.

Logistics Optimization: Reducing the 'Logistics Waste' waterfall by converting COD friction into secured digital revenue.Dashboard Preview

Explore the full data model and interactive visuals by downloading the PBIX file.

Tech Stack

Institutional Portfolio Intelligence & Data Strategy

Content generalized to comply with Non-Disclosure Agreement (NDA) for private equity data.

Data Integrity

99.9% Accuracy

Asset Diversity

Multi-Asset Class

Strategy Focus

Risk Transparency

Executive Summary

Engineered a comprehensive data strategy for Blackmont, focusing on the modernization of institutional portfolio reporting. The initiative replaced manual, fragmented data collection with a high-fidelity intelligence suite designed for executive decision-making.

By implementing a rigorous ETL framework and institutional-grade data governance, the project provided a unified view of multi-asset performance. The outcome was a 'Single Source of Truth' for risk-adjusted returns, enabling senior stakeholders to visualize complex portfolio volatility and asset allocation with surgical precision.

// Technical Logic Flow

Institutional Data Sourcing: Aggregating data from diverse global asset classes and private equity streams.

└──> ETL & Normalization: Standardizing disparate financial metrics and currency formats for consistent reporting.

└──> The 'Single Source of Truth': Designing a centralized data warehouse to eliminate reporting silos.

└──> Risk & Volatility Modeling: Applying statistical models to track portfolio exposure and risk-adjusted returns.

└──> Executive Intelligence (Power BI/Tableau): Delivering high-fidelity, interactive visuals tailored for C-suite and investor relations.

└──> Data Governance: Ensuring strict compliance with security protocols and privacy standards.